New Oregon Cannabis Rules: Part Two – Lenders Must Be Disclosed

New Oregon Cannabis Rules: Part Two – Lenders Must Be Disclosed

Nearly all lenders must now be disclosed to the OLCCJust prior to the new year, we discussed the packet of rules amendments recently adopted by the Oregon Liquor Control Commission implementing the many cannabis bills signed by Oregon governor Kate Brown last year, and promised to dive in depth on a few of the more important changes. In the prior post we discussed new rules for “Marijuana Promotional Events.” This week we dig into a small but important change to the definition of “financial interest” that could have widespread effects on the Oregon cannabis industry: under the new rules, all lenders are pulled into the “financial interest” definition, and must be disclosed.

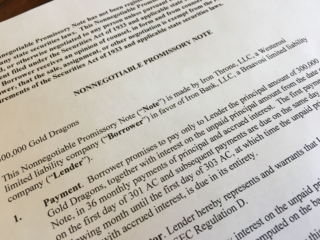

Historically, the definition of financial interest has not included lenders at commercially reasonable rates. But the new amendments add the following to the definition of “financial interest”: “lending money, real property or personal property to an applicant or licensee for use in the business that constitutes a substantial portion of the business cost.” OAR 845-1015(23)(a)(B). The new rules make no attempt to define “substantial portion of the business cost,” which means that some day, someone may test that definition in administrative litigation.

As a bit of background, the OLCC has always been interested in knowing the identity of each individual or entity that has a financial interest in a cannabis license. In the initial application process, applicants must disclose anyone with a financial interest in the company (in many cases, this includes spouses). The application can be denied if the interest holder has an issue that would justify denial if that person was an applicant, such as a (serious) criminal history. A licensee also has several notice requirements relating to anyone with a financial interest in the company:

A licensee must notify the OLCC within 10 days if a financial interest holder has a change in contact information.

A licensee must notify the OLCC within 24 hours if a financial interest holder is arrested or convicted of a misdemeanor or felony. Failing to do this can result in a license revocation.

A licensee must submit a form to the OLCC and receive prior approval before making any change in who has a financial interest in the company. The OLCC has the right to reject the proposed change.

Prior to the recent change, the definition of “financial interest” was already fairly broad: “an interest in [licensee] such that the performance of the [licensee] causes, or is capable of causing, an individual, or a legal entity with which the individual is affiliated, to benefit or suffer financially.” This would of course include royalty agreements, commissions, or lease agreements where a landlord is entitled to a percentage of revenue. The rules also clarify that this definition includes “out-of-the-ordinary” employee compensation, borrowing money at a “commercially unreasonable rate”, giving something of value to a licensee for use in the business, and being the spouse of an owner of the licensee. Anyone in these categories must be disclosed to the OLCC.

This small change is going to have big effects. Due to a lack of institutional lending, most financing in this industry comes from hard money lenders or venture capitalist groups. Previously, the OLCC didn’t care about private financing so long as the loans were commercially reasonable. Now, virtually every lender must be disclosed to the OLCC for pre-approval, which will require background checks and possible fingerprinting. This will slow down investment in an already cash-poor industry and may have a chilling effect on potential wealthy investors who may opt to invest in an industry without such invasive requirements.

Go to Source

Powered by WPeMatico